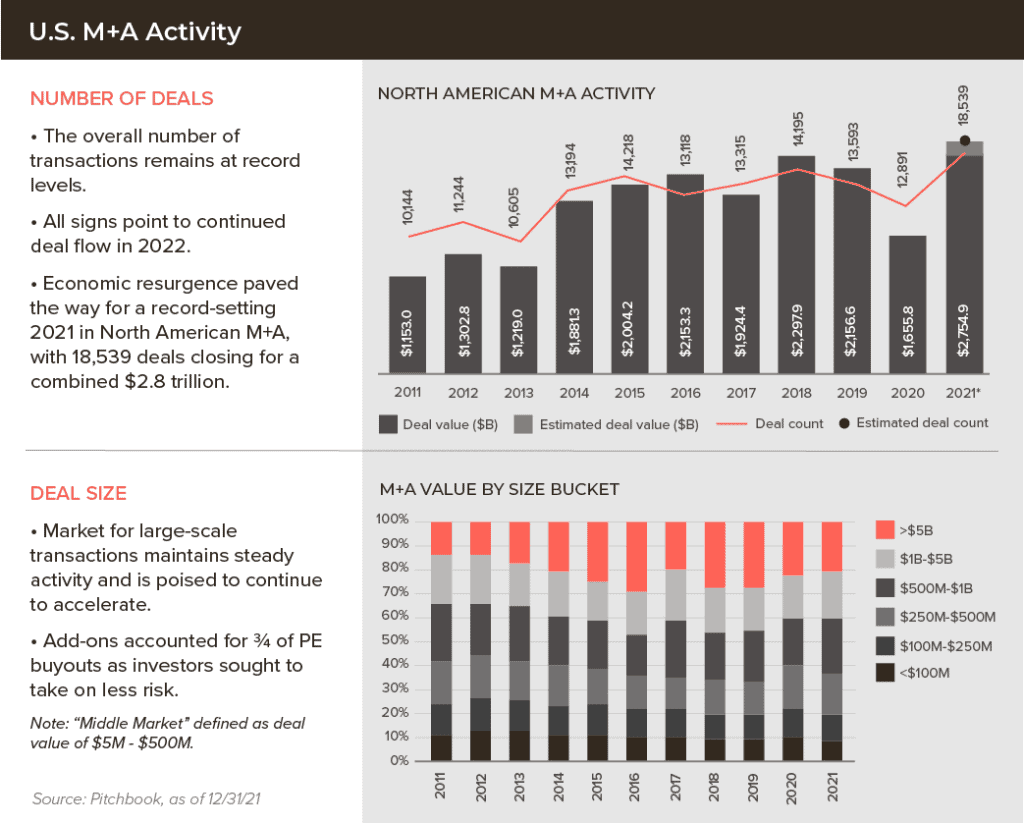

That’s a wrap! Despite the COVID-19-induced slowdown in 2020, mergers and acquisitions (M&A) activity thrived in 2021. Prior records were trounced, and sellers benefited from a rise in market valuations. Strong public equity markets supported the resurgence, reflecting high business confidence and lifting the buying power across the ranks of public companies.

The unprecedented breadth and velocity of the deal market led to deals across all sectors, sizes, transaction types, and geographies having healthy showings despite COVID variants, inflation, and higher regulatory burdens. Dealmaking figures benefited as deals were pushed back from 2020 because of COVID-19-related uncertainty, while other deals were pulled forward from 2022 for tax-related reasons.

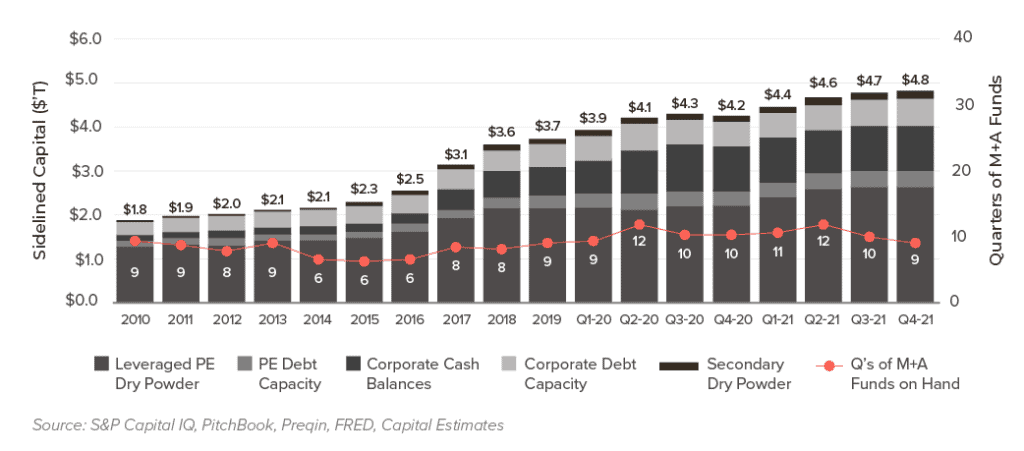

The sheer volume of deals completed wasn’t the only record reaching new levels. The coupling of ample cash and debt availability, a wave of sellers coming to market to avoid anticipated tax hikes, and the pressure to deploy capital continued to push values to all-time highs.

Many industries, if not most, experienced intense competition for deals, and multiples elevated to 2019 levels or higher in 2021. With multiples up across the board, many investors have shifted their dealmaking focus to companies with compelling industry growth trajectories and attractive business models, further increasing competition for the most promising companies.