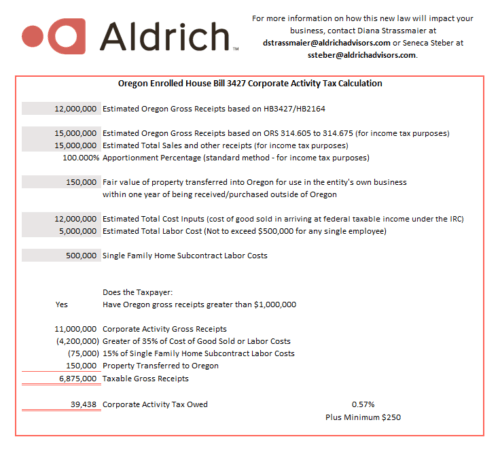

On May 16, 2019, Oregon Governor Kate Brown signed House Bill 3427A, creating a new Oregon Corporate Activities Tax. The bill was later modified by House Bill 2164, which included clarifications, technical corrections and a number of other changes. The tax is expected to raise more than $2 billion per biennium for Oregon schools and would apply to Oregon sales for companies with revenue greater than $750,000. The tax would be in addition to the existing personal and business income and excise taxes.

Highlights

- The corporate activity tax will be imposed on all businesses with nexus in Oregon, including C Corporations, S Corporations, Partnerships, LLCs and sole proprietorships.

- All businesses who expect to generate more than $750,000 in revenue for a year will be required to register with the state within 30 days of their expectation of meeting that level for the year and a penalty of $100/month will be assessed for failing to register, up to $1,000 per calendar year.

- The tax rate is $250 plus 0.57% of commercial activity over $1,000,000.

- Commercial activity generally includes gross receipts less the greater of:

- 35% of cost inputs

- 35% of labor inputs

- Commercial activity generally includes gross receipts less the greater of:

- The tax is imposed on the seller and is not a tax directly on the purchaser.

- The tax would be based on a taxpayer’s gross receipts and the tax would be due regardless of profitability.

- The tax would be effective for tax years beginning on or after January 1, 2020, and quarterly payments are due April 30, July 31, October 31 and January 31.