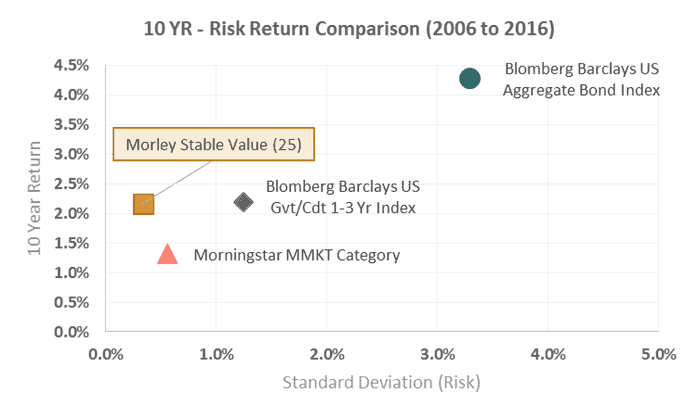

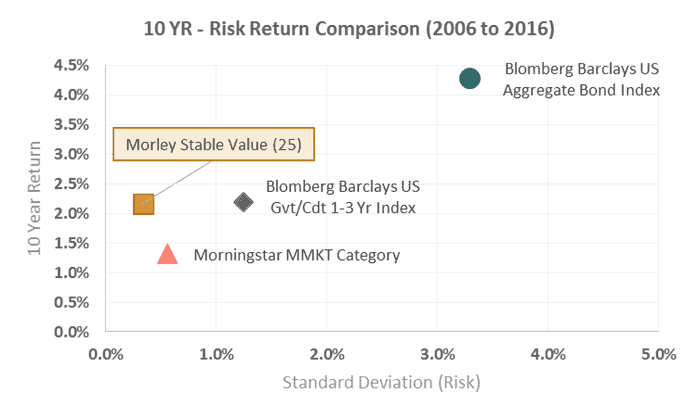

Historically, stable value funds have been able to generate returns exceeding typical money market funds with similar volatility characteristics (see chart). While the portfolio of bonds is managed just like any other short duration bond fund, stable value funds use an insurance wrapper to account for the fluctuations in bond prices. This characteristic creates the stable and predictable return profile participants covet but adds complexity for plan sponsors. In times of economic recession or stock market volatility, stable value funds can be one of the most valuable investment options available. While many other investment returns are much lower in hard times, stable value funds remain just that, stable. That said, the insurance protection has a price. The costs of the insurance wrappers went up following the financial crisis of 2008, a period during which the market values of stable value funds were well below book values and some insurers exited the market. From pre-crisis levels of lower than 0.10%, post-crisis levels reached as high as 0.25%. Moreover, stable value funds are not FDIC insured or registered with the SEC which results in limitations in terms of transparency and makes comparative analysis challenging.

Late last year, the SEC pushed through sweeping changes to the way money market funds are managed and regulated, creating a challenge for managers. At the same time, money market funds have been plagued with paltry returns amid today’s low interest rates, a problem that has caught the attention of attorneys who are suing retirement plans over fees. Since December 2015, at least three lawsuits have been filed alleging certain 401(k) plan fiduciaries breached their duty under the Employee Retirement Income Security Act of 1974 by retaining money market funds as an investment option rather than stable value funds. The recent likelihood that the low yields provided are not sufficient to cover plan expense, resulting in a principal loss for the participant, has added to concerns.