You’ve spent years building your business, and now you’re starting to imagine what your future holds—whether that’s in one year or five years. For many owners, the next step may be the most important, either by selling the business or by beginning to build more value in your business for a potential future sale down the road. But at the end of the day, selling a business is an increasingly complex and time-consuming process, which is why 80% of businesses that go to market never sell.

Increasingly Competitive Market for Sellers

Driven by retiring baby boomers, some 73% of privately held companies in the U.S. will transition in the next 10 years, creating a $14 trillion opportunity1. In addition, 69% of business owners identified an exit strategy on their priority list2, creating even more competition for sellers.

Without a clear strategy to get the best offer possible, or in responding to an unsolicited offer directly, owners may be challenged in getting prices for their company that reflect the hard work put in to build their business.

Your M&A Team—Focused on Your Goals

You’ve built a business, so wondering if you need help to sell that business is a completely understandable question. The reality is the process is complex and time consuming. Tying to focus on running the company and selling it at the same time risks success in both areas.

Business owners considering a sale should bring together an experienced team focused on delivering against their goals. An ideal team often consists of:

- An attorney who specializes in mergers and acquisitions

- An M&A advisor who can help attract the right buyers, maximize the purchase price and terms of the sale, and navigate the complex and time-consuming process to close

- A tax accountant to help structure your transaction and provide the M&A advisor and wealth advisor with valuable intelligence regarding tax liabilities and structuring associated with your deal

- A wealth advisor to help you plan for life after your sale and keep your nest egg safe after your liquidity event

Ideally, a business owner will have this team in place well before they start looking for a buyer. But even owners who believe they have a willing and able buyer will benefit from pulling a full team together. An offer and letter of intent (LOI) is often just the beginning of a lengthy process that will likely require hundreds of hours of diligence, negotiation, and documentation to ensure a successful close, regardless of transaction size.

The Value of an M&A Advisor

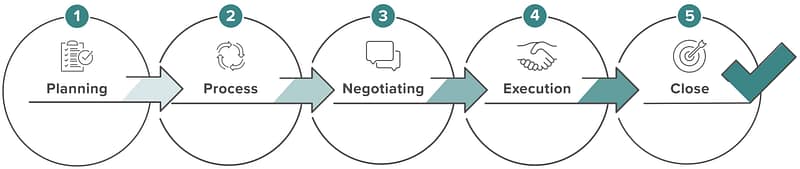

When thinking about the right team to have in place for a transaction, it’s important to consider the different steps of the sales process, to be sure you have access to experienced specialists along the way. An advisor can add significant value across every step of the sales journey .

- Planning: An M&A advisor will work with the seller to understand their objectives and key business characteristics, including conducting a business valuation, then help identify and vet potential acquirers through a marketing strategy that best positions the company for a successful sale process. This includes developing:

- Marketing materials

- Normalized historical financials

- A credible financial forecast

- Diligence materials before contacting buyers

- Process Structure: Having a third party run a transaction process can help create a competitive dynamic amongst multiple potential buyers.

- A well-designed process with structure and bid deadlines overseen by professionals creates competitive tension that maximizes values.

- Having multiple parties at the table also increases the likelihood of getting a deal done—the fear of missing out (FOMO) on the opportunity to acquire your company is real.

- Negotiating Dynamics: Using an advisor to handle communication with potential buyers and negotiate the transaction can add an important separation between the buyer and seller. This allows the “principals” on each side to maintain a positive relationship while advisors work through any difficult issues, including price and deal term discussions.

- Execution: Having an experienced M&A advisor take on the primary role of executing the sale process frees up the management team to continue running the business.

- A sale process is time –consuming, and the business must continue to perform well to maximize value.

- If an advisor is not involved, it can be overwhelming for management to run an M&A process and business operations, as buyer diligence and discussions can monopolize their time.

Investing in Your Transaction Team

One of the largest misconceptions is that selling your company on your own will save you money. While that’s possible, the reality is that not having the right team in place can often cost you more in the long run, and potentially make the deal harder to close.

Of course, putting together the right team to support your transaction will be an additional investment. While an M&A advisor’s fees typically range from 2-5% of the transaction value for lower middle–market sales, they can help you avoid traps related to key negotiated transaction items. Neglecting proper analysis and negotiation of key economic terms could cost a seller hundreds of thousands to millions of dollars. Check out Four Ways Owners Can Maximize the Value of Their Business During a Sale.

The process of selling a business is an arduous and complicated one. However, with the help of a team of experienced advisors, your outcome can be the one you envisioned for yourself.

If you have questions about transitioning your business or creating a succession plan, fill out the form below to connect with the Aldrich Capital team.