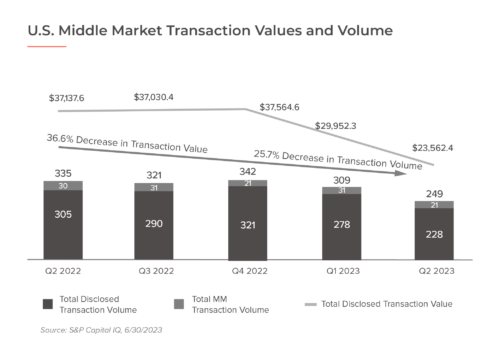

During the second quarter of 2023, the M&A market remained active, though it faced some challenges due to economic uncertainties and increasing interest rates. These factors led to fewer deals and overall lower price levels for acquisitions. However, plenty of capital was still available, keeping the market alive and kicking—even if the volume of deals was somewhat reduced.

Amid it all, strategic acquirers took center stage in the middle-market M&A scene, making up a whopping 89.5% of all deals, the second-highest level of strategic activity in five quarters. On the other hand, financial buyers, like private equity firms, represented the remaining 10.5% of deals.

Despite the challenges, it’s evident that the M&A world remained dynamic. Strategic players were actively seeking opportunities, and with plenty of capital at hand, private equity buyers stood ready to make deals when the opportunity arose.

Overall, it’s clear that businesses and investors remained cautiously proactive amid the economic uncertainties and rising interest rates, which kept the M&A landscape in the lower-middle to middle-market interesting and moving.

Distribution of market share by sector for Q2 2023 in deal activity resembled that of Q2 2022, with one notable change: the Financials sector significantly increased its share. Consumer Discretionary, which was the dominant sector in Q2 2022, saw a decline to 12% in Q2 2023, ceding its position to Healthcare. Industrials, Financials, and Information Technology each made up 13-16% of the activity, followed by Consumer Discretionary at 12%.

Over the past year, several noteworthy trends have emerged. Consumer Discretionary deal activity decreased by 6%, while Financials and Healthcare experienced significant upticks, gaining 2-4% in overall deal percentages. Each sector faced unique impacts from external factors such as interest rate fluctuations, global economic conditions, trade disputes, political challenges, pandemic-related supply chain issues, and evolving governmental policies.

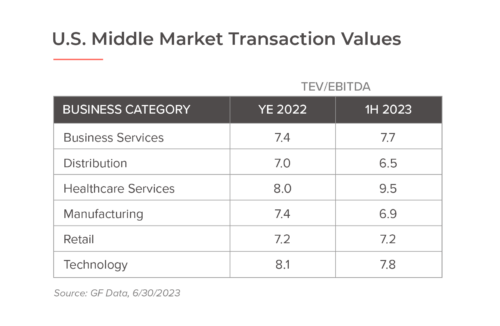

As noted in the graph below, middle-market transaction values have dipped slightly across business categories. However, many quality businesses in the lower-middle market have kept pace with multiples paid over the last several years by buyers. Simply said, if you are growing, have better margins than your industry, and can continue to scale, buyers will continue to pay up!