Middle-market M&A activity started the year subdued as buyers continued to err on the side of caution. Middle market public and private company transaction deal value and volume for Q1 2023 decreased from Q4 of 2022 to continue an ongoing decline. Compared to Q4, values and volume decreased by 20.3% and 9.6%, respectively. Q1 2023 value and volume fell 28.8% and 25.2%, respectively over Q1 2022. During Q1 2023, the M&A environment was still active; however, rising interest rates and economic uncertainty have reduced the supply of deals and hurt overall multiples. Capital availability was still quite high, and the economy maintained its strength, fueling the M&A market even with lower volumes.

There is no getting around the effect of rising interest rates on business valuations. If a buyer pays more to service its debt, there is less available to pay the sellers. The falling public market reduces a buyer’s estimated exit value. Still, we have seen that the lower middle market is somewhat insulated from these forces.

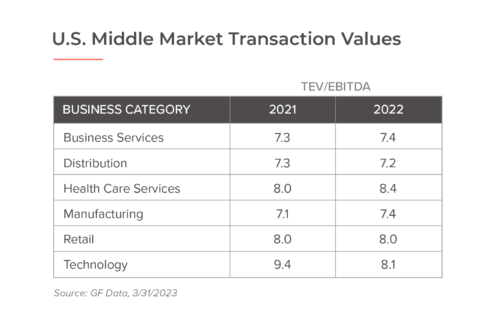

The looming recession and the fatigue of business owners, due in part to supply chain issues and labor shortages, are certainly the most significant factors driving deal flow in the lower middle market. As shown below, lower middle-market multiples across most business categories have remained in line with recent averages.

Corporate strategics with strong balance sheets are competing more broadly with private equity as each continues to focus on quality business acquisition to create value, albeit at a slower, more selective pace than the last 18 months. Still, an encouraging sign for business owners weighing their options in 2023.