In 2023, M&A markets in the United States decreased in deal volume, primarily because of ongoing global economic uncertainties. However, the lower middle market (enterprise values $10M-$500M) remained active in mergers and acquisitions. These M&A deals focused on high-quality and strategic opportunities.

Several factors caused market uncertainty in 2023. Among them: concerns about recession, rate hikes to combat inflation, bank failures, international tensions, and China’s interest in Taiwan. Even so, there’s a more positive outlook as we enter 2024, though some factors continue to impact M&A activity.

M&A Trends

During the COVID-19 pandemic’s onset, M&A activity came to a standstill for much of 2020. 2021 saw an unprecedented surge in completed deals after the Federal Reserve slashed interest rates to historic lows. In response, numerous PE firms rushed to execute M&A deals, seemingly buying any companies looking to sell.

But the Fed, aiming to rein in inflation, hiked interest rates multiple times, causing deal activity to plummet. Since the start of 2022, M&A activity has steadily declined because of escalating debt costs and concerns over recession. Another factor is a sudden end to fundraising, as limited partners grappled with portfolios heavily skewed toward private equity investments.

In 2021, PitchBook data indicated a total of 1,839 M&A deals in the middle market, at a combined value of $878.3 billion. In stark contrast, 2022 saw 1,307 PE exits totaling $321.5 billion. The downward trajectory continued in the first half of 2023. Only 378 middle-market M&A transactions were concluded, with a combined value of $139.6 billion.

The final deal count for 2023 is estimated to be down approximately 20% from 2022. The good news is that disclosed deal value substantially improved in the second half of 2023 relative to the first half of the year. This uptick could foreshadow a strong year ahead.

Valuation Trends

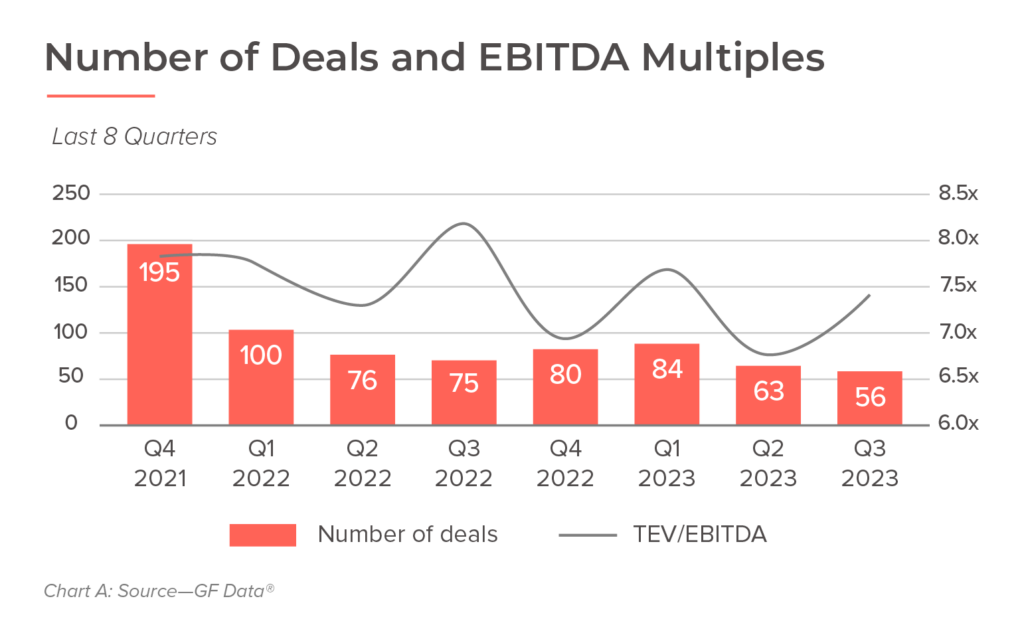

According to GF Data, average multiples in the lower middle market were down in 2023 relative to 2022. However, they began to moderate and even increase in the second half of the year (see Chart A below).

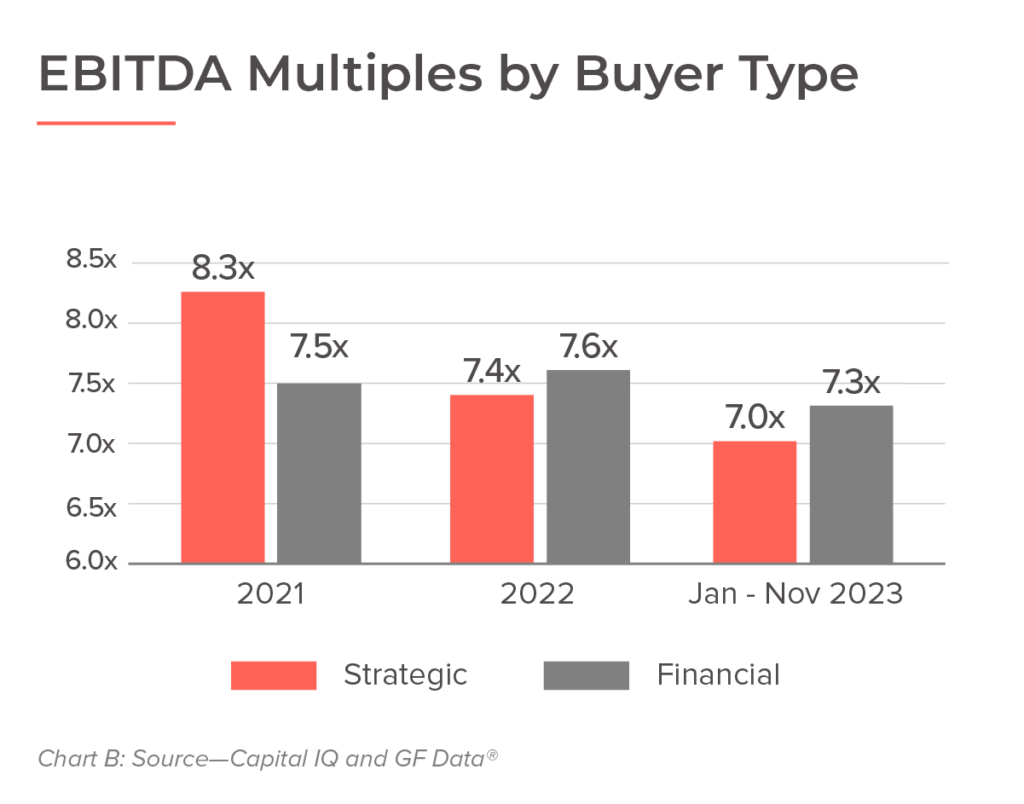

This dynamic incentivized some sellers to transact. It also proved buyers were motivated to deploy capital for quality assets. Looking across business sectors, the average EBITDA multiple for the last 12 months by sub-group ranged from 5.9x for deals with an enterprise value of $10-$25 million to 11.2x for deals in the $250-$500 million range. Further, data shows the EBITDA multiples declined by both strategic and financial buyers since the peak of 2021 (see Chart B below).

Outlook + Recovery

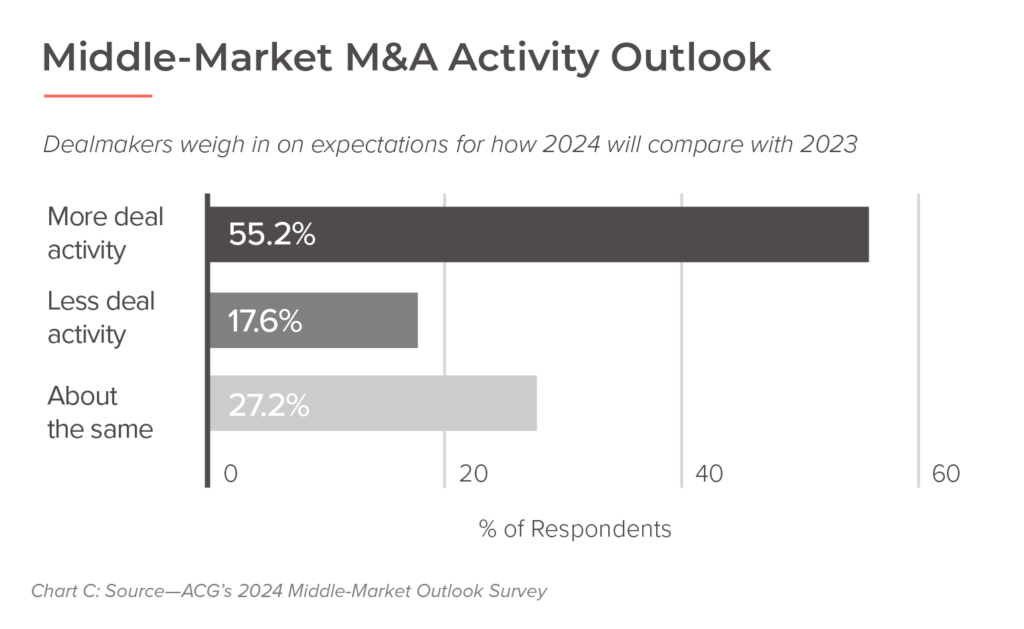

Despite concerns such as elevated borrowing costs and the prospect of a slowing economy, we have reason for optimism in 2024. After sitting on the sidelines last year, private equity sponsors want to put money to work.

Most financial sponsors have record levels of cash, and their investors expect to realize returns. These are two reasons why private equity firms should ramp up capital deployment as the economy stabilizes. Strategic acquirers are also positioned to grow through M&A as corporate balance sheets reflect record levels of cash.

While concerns about economic growth persist, many analysts and CEOs have shared encouraging corporate outlooks going into 2024. Communications from the US Federal Reserve to hold steady or lower the benchmark borrowing rate have helped reduce uncertainty.

This, in our view, is a key catalyst to deal-making between buyers and sellers in the middle market. (see Chart C below). Further, direct lenders can provide financing to get deals done, continuing to provide a viable alternative for buyers.

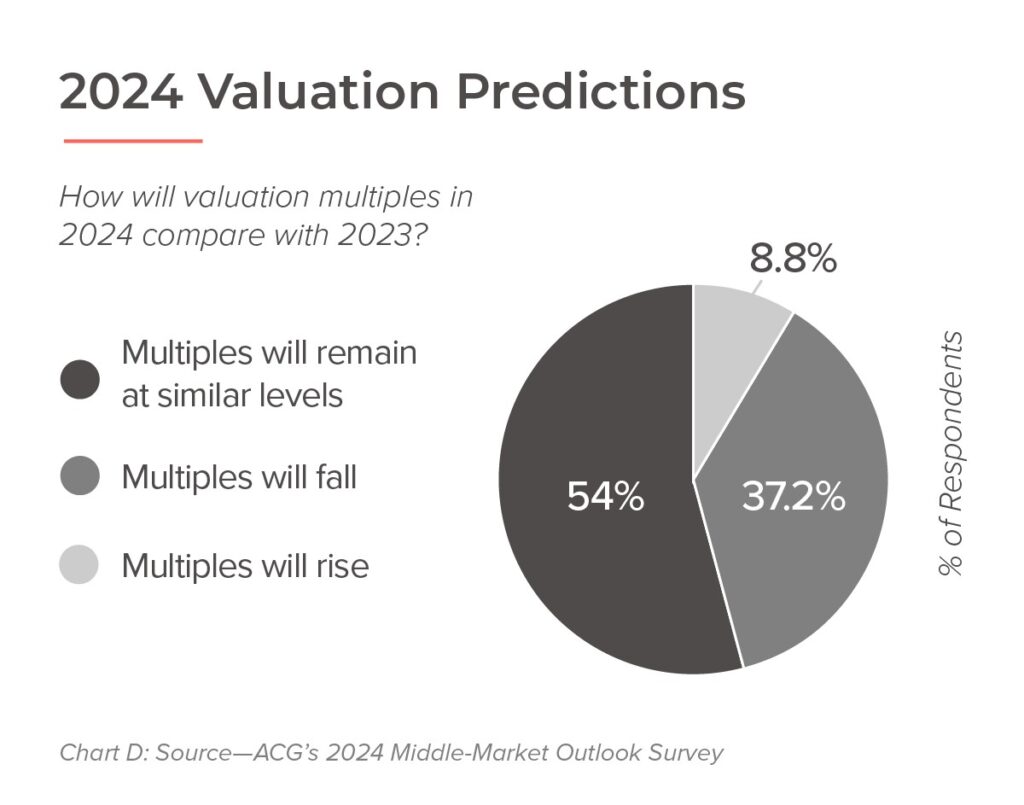

Lastly, whatever they are, economic conditions will certainly drive valuations. Most believe valuations have stabilized (see Chart D below). This should help buyers and sellers more consistently align on transaction multiples. Most of our clients have shifted valuation expectations away from those they may have had at the top of the market in 2021.

While there remains uncertainty in the marketplace, several factors have lined up nicely to give M&A markets a boost in 2024. Regardless, one thing has not changed: buyers want quality businesses. Those sellers who are growing, have strong margins, and can scale will almost certainly find interested partners.

Planning the Future of Your Business

Showing meaningful performance trends to the market is critical to maximizing value upon a sale. Establishing these trends will take time. For those business owners contemplating a transaction over the next several years, failing to plan early may mean leaving significant value behind.

If you have any questions regarding the trends specific to your industry or need help preparing for an eventual ownership transition, please reach out to your Aldrich Advisor.