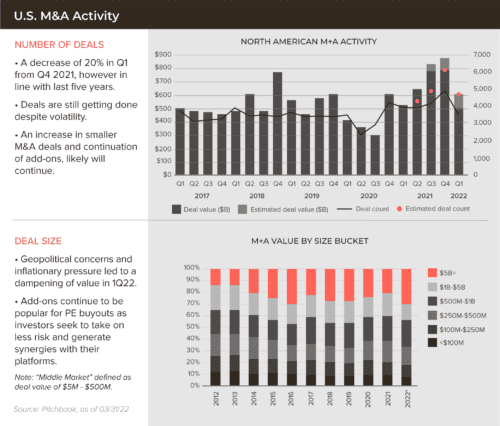

As geopolitical uncertainty grew, some investors viewed the turbulence as an opportunity to secure more reasonable valuations than the lofty multiples paid in 2021. Additionally, high interest rates played a growing role in dampening M&A activity and valuations throughout the quarter. As anyone shopping for groceries these days knows, inflation continued to rise, with the U.S. CPI posting an 8.5% year-over-year increase as of March 31, 2022, the fastest inflation rate since 1981.

Okay, so everything is more expensive, but how does this impact your company’s value? Here’s a quick Econ 101 refresher: As the Fed looks to stem the rise of inflation, they have announced their intention to hike interest rates. As interest rates go up, the cost of borrowing will follow suit. This increases discount rates applied by investors to future cash flows of companies.

As discount rates go up, valuation comes down, all else being equal. That last phrase is important because while all signs point to interest rates rising, pushing valuations downward, the abundance of capital on corporate balance sheets and in PE coffers remains at record levels and continues to grow. The obligation (and often requirement) to put this money to work means investors will continue to seek out and pay up for quality companies.

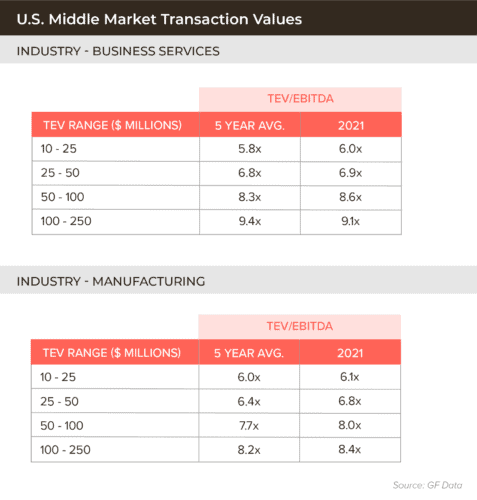

Deals continued to average 7.5x EBITDA for middle-market companies, in line with prior quarters. While this average does not apply to every industry, data does point to some industries, including Business Services and Manufacturing that we have noted in the charts below, enjoying even higher multiples.

The desire to find and attract quality companies with better-than-average growth and margins has investors paying premiums often reaching 30% above average.