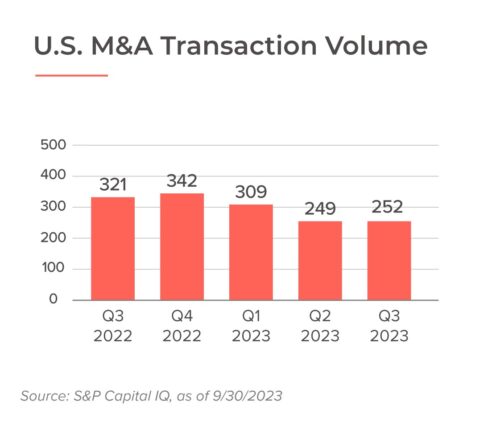

Q3 2023 brought substantial headwinds to global M&A activity, with a significant dip in deal value. Compared to the previous quarter, global M&A value plummeted by close to 20%, marking the lowest quarterly total in nearly a decade and striking an almost 50% decrease from the peak of two years ago. Despite a minor drop in the number of deals, year-to-date deal value is down by 22.5%.

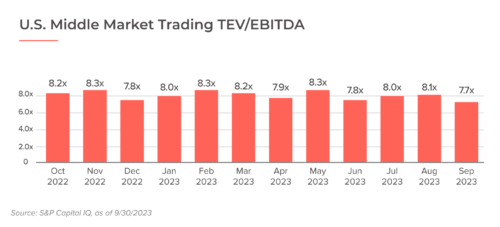

In response to these challenges, dealmakers have pivoted toward smaller transactions and adopted a more cautious approach to substantial “megadeals.” Private equity’s share of M&A deals contracted to 33%, a decline from its Q4 2021 peak and the second consecutive year of decrease after a decade of expansion. The reduced access to leverage is evident in the significant drop in the debt-to-enterprise value (EV) ratio for US leveraged buyouts in 2023. peak and the second consecutive year of decrease after a decade of expansion. The reduced access to leverage is evident in the significant drop in the debt-to-enterprise value (EV) ratio for US leveraged buyouts in 2023.

Nevertheless, conditions for a future M&A market rebound persist. A substantial reservoir of unspent private-equity dry powder and substantial corporate cash reserves suggest the potential for a recovery in M&A activity.