Washington State Governor Bob Ferguson recently signed three new Senate Bills into law that will substantially impact individuals, businesses, and high-income earners.

The summary below highlights the key provisions most relevant to business owners and individuals.

Changes for Individuals

Increased Capital Gains Tax

Starting January 1, 2025, a 2.9% surtax applies to capital gains over $1 million. This surtax is on top of the existing 7% long-term capital gains tax, which already applies to gains over $270,000 per year. As a result, individuals with over $1 million in long-term capital gains will face a total state capital gains tax rate of 9.9%.

Estate Tax Reforms

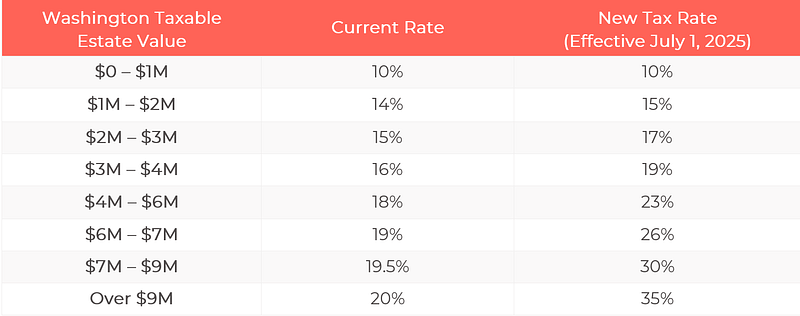

Beginning July 1, 2025, the Washington estate tax exclusion amount will increase to $3 million from the previous threshold of approximately $2.193 million. This exclusion will be adjusted annually for inflation.

The newly enacted law increases the top estate tax rate from 20% to 35% and increases the deduction for qualified family-owned businesses will rise from $2.5 million to $3 million.

Changes for Businesses

Expanded Sales Tax on Services

Washington’s retail sales tax has been broadened to capture previously exempt services beginning October 1, 2025. Newly taxed services include:

- IT services

- Website design + development

- Security + monitoring

- Temporary staffing

- Advertising

- Live presentations

- Fitness facilities

- Digital software services

Under the newly enacted legislation, the definition of retail digital automated services (DAS) has been expanded. As a result, electronically delivered services, including those involving data processing or services predominantly performed by human effort but delivered electronically, will generally be subject to retail sales tax. However, key exemptions remain in place:

- Sales transactions between affiliated companies may continue to qualify for exemption.

- Services provided to hospitals and other healthcare-related institutions are explicitly excluded from these new taxation rules.

Businesses with taxable retail sales exceeding $3 million in 2026 will be required to make a one-time sales tax prepayment. This prepayment, due by June 25, 2027, should equal 80% of the state sales tax collected for the June 2026 reporting period, with the remaining tax balance due July 26, 2027. Late payments and underpayments are subject to a 10% penalty with relief available in limited circumstances.

Business & Occupation (B&O) Tax Adjustments

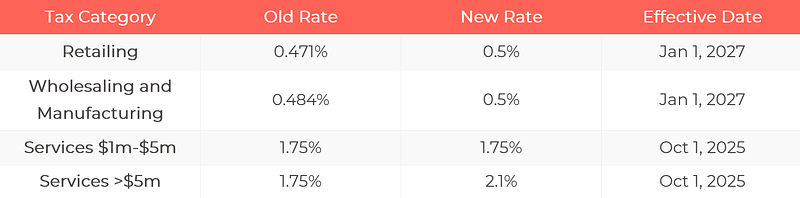

The standard B&O tax rates for retailing, wholesaling, and manufacturing will increase effective January 1, 2027, to 0.5%.

Service-based businesses with annual gross receipts exceeding $5 million will see their Business & Occupation (B&O) tax rate increase from 1.75% to 2.1%, effective October 1, 2025. Businesses with annual gross receipts between $1 million and $5 million will continue to be subject to the existing 1.75% rate.

Additionally, a new temporary surcharge of 0.5% would apply to businesses earning over $250 million annually from 2026 through 2029.

What's Next?

Now that these new laws are in place, it’s important to start planning ahead.

Businesses should consider the impact of the new B&O tax rates on their pricing. Additionally, if your business offers services that will become taxable, now is the time to develop a plan to identify those services and ensure sales tax is correctly applied by the October 1 effective date.

Individuals with large estates should be speaking with their tax advisors about potential impacts. It’s also a good time to remember that gifts made during your lifetime are not subject to Washington’s estate tax. Those who expect to have more than $1 million in capital gains this year or in future years should also talk with their advisors to understand how the new surtax could apply and what planning opportunities may be available.

Have questions about how these changes might affect you or your business? We’re here to help.