In 2017, the Tax Cuts and Jobs Act (TCJA) created IRS Code Section 250, allowing certain taxpayers a deduction for Global Intangible Low-Taxed Income (GILTI) and Foreign-Derived Intangible Income (FDII). FDII was created as an export incentive to encourage US businesses to locate intangible property in the US rather than foreign jurisdictions.

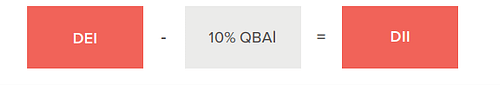

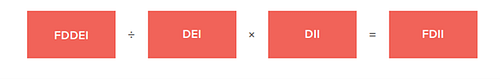

Instead of identifying specific intangible property that produces income that qualifies for FDII, the TCJA identified an amount deemed to be income from tangible property (like buildings and equipment) and excludes that amount. Because FDII defines intangible income so broadly, many companies operating in the US may already receive intangible income for FDII purposes. When these companies sell overseas, they neatly fit the activity the TCJA intended to promote with FDII.

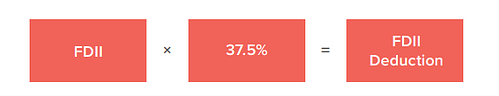

In effect, FDII created a significant tax benefit for US companies selling goods and services overseas. As a result, US companies may get a corporate tax rate of 13.125% on sales to foreign people for foreign uses. FDII essentially created two income categories for US C Corporations, FDII income taxed at 13.125%, and non-FDII income taxed at 21%.