Most nonprofit organizations are required to report expenses by functional classification, either for financial statements, the 990, or both. Ensuring the allocation methods used to prepare these reports is reasonable and appropriate is a key management function. With the changes coming for all nonprofit organizations who prepare financial statements in accordance with generally accepted accounting principles, this will become even more significant. Understanding the terminology and types of expenses that can be recorded in each category is essential, and the starting point for this determination is understanding how to report program expenses.

The Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 958-720-45-2 provides guidance for tracking expenses by functional classification and rending the associated financial statements. It recognizes two categories of expenses: program services and supporting activities. Program services relate to activities resulting in goods or services provided to beneficiaries, customers, or members to advance the program’s purpose or mission. These costs should include any direct conduct of a program as well as direct supervision of the program and other supporting activities.

The standards require major programs to be reported separately, but how those programs are determined and how many should be reported is up to the discretion of management. Executives should take into account the program objectives, the nature of services, the constituents served, the magnitude of the program, compliance with regulatory and/or grant requirements, and other factors that may be relevant to the users of the financial reports.

In addition, the definition of the program creates an opportunity to tell the organization’s story and highlight its distinct contributions to the community.

The guidance recommends a program be reported separately if it meets at least one of the following criteria:

- Revenue or expenses are 10 percent or more of the organization’s total

- Assets or liabilities of the program are 10 percent or more of the total for the organization

The general rule is 75 percent of program expenses should be reported in separate program categories unless there really is only one program.

Although uncommon, reporting only a single program category may be adequate to cover the service the organization provides. For example, private foundations may use a single program reporting classification to address grant-making making activities, especially when focused on a narrow issue area or geography. In addition, new or small organizations may only have one major program to focus on.

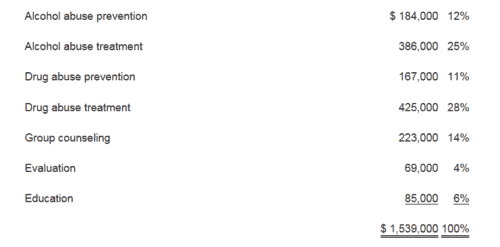

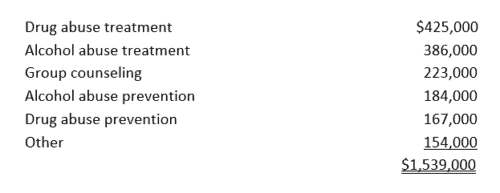

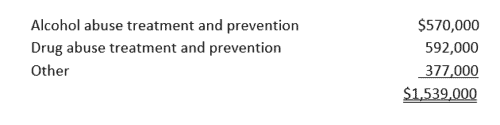

A sample organization has the following programs:

Management could choose to report these expenses in a variety of ways. If they choose to report based on quantitative measures, it might look like this:

If they want to report based on some other qualitative measures, such as by program focus, it could be reported like this:

Functional classification and expense allocations should be reviewed periodically for relevance and accuracy. This exercise might spark interest in training on new regulations, reporting standards and other related industry developments. It may also challenge management to dust off the organization’s policies and procedures to ensure they reflect all of the latest practices.

Cost allocation is a complex subject that far exceeds the scope of this brief article. Fortunately, our industry specialists are ready to help you navigate the requirements and create strategies and systems to protect your organization’s interests, address compliance, and minimize the burden on staff.