You’ve spent years building your business, and you’re starting to imagine what your future holds. For many owners, the next step may be the most important: selling the business.

Some business owners may find themselves with potential buyers reaching out unsolicited, while others may not know where to start a sale process. Regardless of where you are along the sale continuum, it is most likely your first time selling a company, and if you are not prepared, the likelihood of getting the best deal for years of hard work is lower than you might think.

We often get the question from business owners—is an M&A advisor/investment banker really necessary? What value do they bring to the table? Can’t I do this myself?

Before we answer those questions, consider that 80% of businesses that go to market never sell. There are several reasons, but an overwhelming factor is the lack of planning. Many of our clients who come to us after a failed M&A experience now recognize the depth of knowledge and focus needed to ensure a successful transaction.

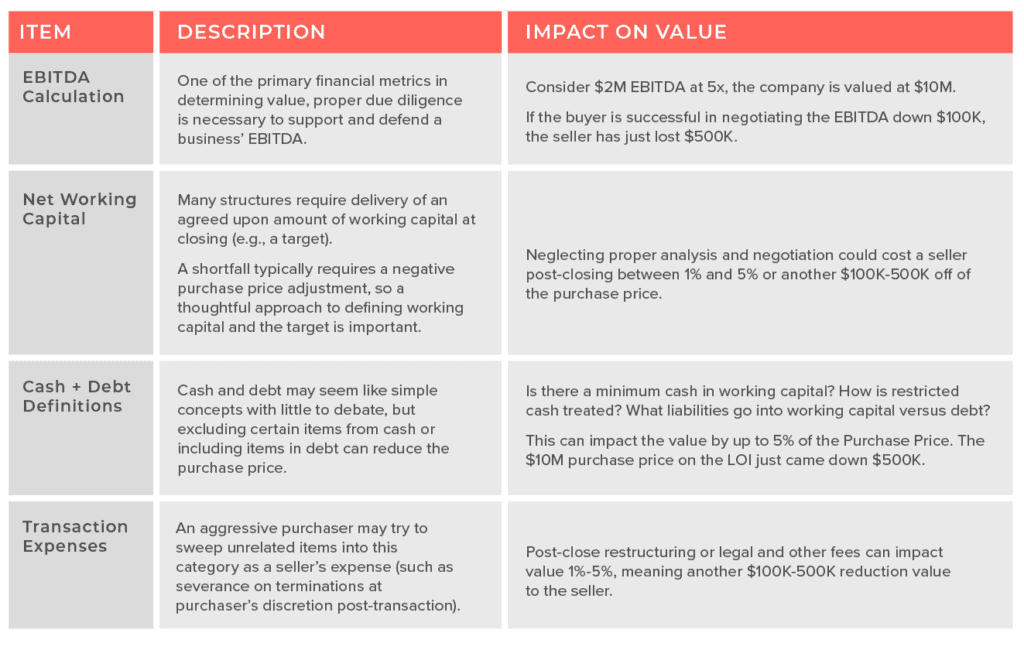

Even for those who believe they have a willing and able buyer, the “game” has just begun. After achieving a letter of intent (LOI), the process will likely require hundreds of hours of diligence, negotiation, and documentation to ensure a successful close, regardless of transaction size.