Outsourced Accounting

Services

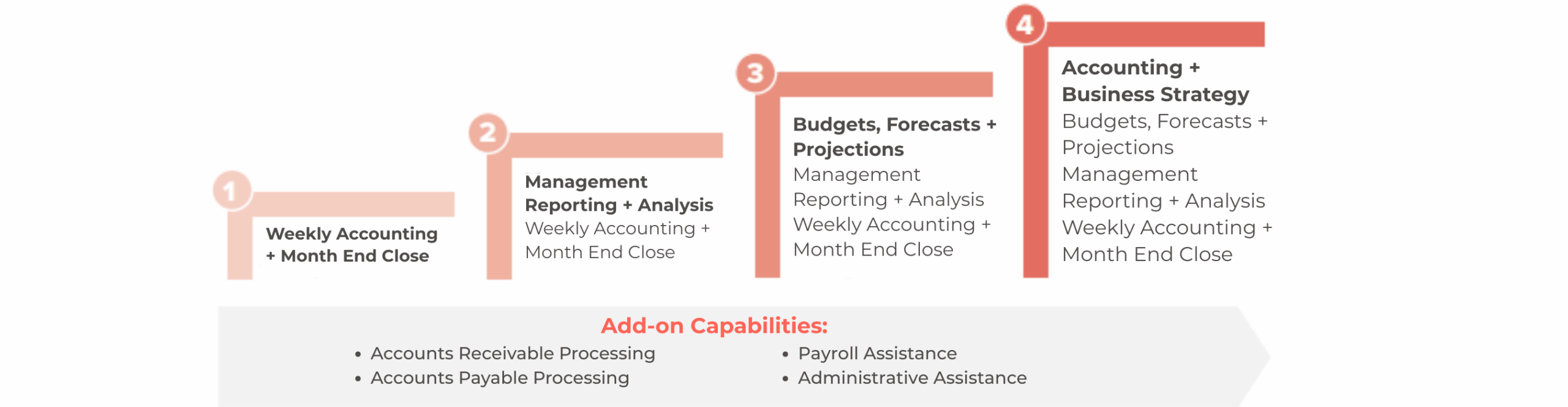

Services are offered in customizable tiers that are tailored to you and your business.

Service Tiers

- Code bank and credit card feed activity

- Record accounts receivable and accounts payable

- Track, prepare supporting schedules for, and reconcile balance sheet accounts

- Post adjusting journal entries

- Perform month end close

- Hold a monthly pre-close meeting to review open items and discuss process improvement

- Prepare weekly cash status reports

- Prepare monthly management reporting packages

- Provide interactive financial dashboards

- Hold a monthly accounting review meeting for reporting review and analysis

- Facilitate the annual budgeting process and prepare the annual budget

- Prepare recurring forecasts and cash flow models

- Prepare scenario-based projections

- Liaise with banks, attorneys, and other third-party stakeholders

- Assess processes and develop internal controls

- Provide software recommendations and implementation support

- Conduct break-even and profitability analyses

- Assist with pricing strategy and compensation planning

- Support strategic planning and roadmap development

Add-on Capabilities

- Prepare and send invoices to customers

- Monitor outstanding accounts receivable

- Prepare accounts payable runs for your approval and payment

- Monitor outstanding accounts payable

- Coordinate with your payroll and benefits providers, including:

- Assist with setup and removal of employees within your payroll application

- Run payroll through your payroll application

- Assist with setup and removal of employees within your benefits portal

- Perform benefits uploads

- Prepare Form 1099s

- Prepare personal property tax returns

- Provide income tax documentation and coordinate with your income tax provider

- Provide attestation documentation and coordinate with your financial statement attestation provider

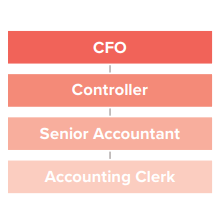

Your Team

Your Team is made up of the ideal combination of CFO, Controller, Senior Accountant, and Accounting Clerk – ensuring your accounting department is staffed the way it should be.

Your CFO is your primary strategic advisor. They support your Controller; lead budgeting, forecasting, and projection efforts; and partner with you on accounting and business strategy initiatives.

Your Controller is your primary relationship manager and accounting advisor. They manage all aspects of your engagement, oversee the accounting team, lead month end close and reporting, and provide regular insights and analysis.

Your Senior Accountant is your primary day-to-day contact. They oversee your Accounting Clerk, prepare month-end close and reporting, lead payroll and administrative tasks, and ensure your day-to-day accounting operations run smoothly.

Your Accounting Clerk supports the accounting team behind the scenes. They code transactions, prepare accounts receivable, process accounts payable, and assist the team with their daily accounting activities.

Pricing

Pricing is predictable through a tailored, subscription-based approach, with services delivered under a predetermined fee.

Every new engagement begins with onboarding and implementation. This includes systems access and setup, documentation of your accounting cycles and processes, reconciliation of beginning balances, and any necessary catch-up or clean-up work to bring your accounting current. The fee for onboarding and implementation is structured as a one-time fee, in addition to your monthly fee for recurring services.

Our recurring services are offered through a subscription-based monthly fee, tailored to you and your accounting needs. The fee for recurring services is invoiced monthly and can be set up for autopay if you choose.

In addition to our recurring services, we can support you with one-time special projects as they arise. These projects are scoped separately in collaboration with you to ensure alignment on desired investment and outcome. The fees for special projects are structured as one-time fees, in addition to your monthly fee for recurring services.

Next Steps

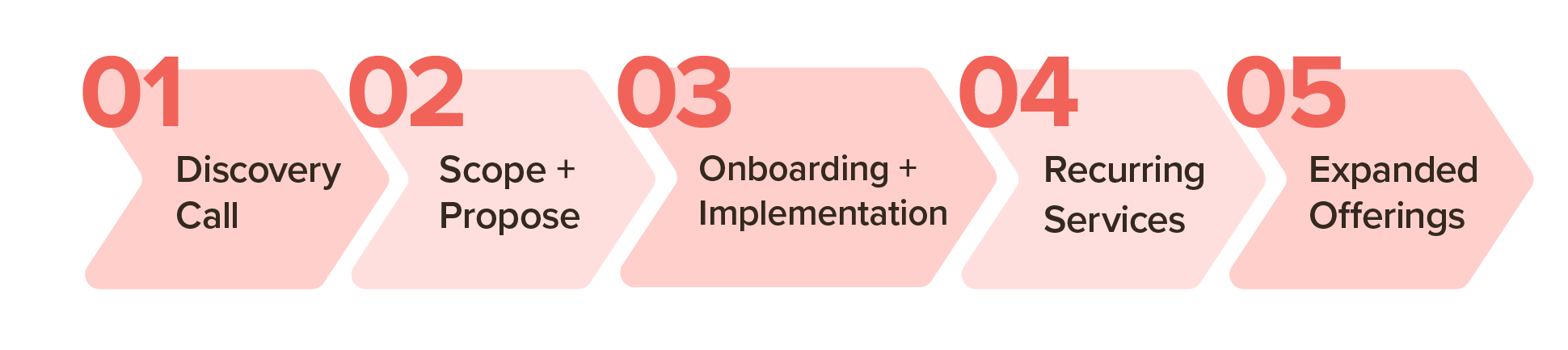

Our next steps are designed to understand your goals, deliver meaningful value, and create a lasting partnership.

Our relationship begins with a discovery call where we take the time to understand your current accounting systems, cycles, processes, team, and pain points. We’ll learn about your business, your goals, and what you value most in an accounting partnership. During this conversation, we’ll also share more about our service offerings, approach to client service, and the benefits of working with our accounting team.

Following our discovery call, we’ll send you a request list based on our discovery call conversation. This additional information will help us confirm fit, build customized service options, determine pricing, and prepare our proposal. Once complete, we’ll send our proposal and schedule a follow-up meeting to review it together, answer questions, and discuss timing for beginning the onboarding process.

Once engagement letters are signed, we’ll schedule a kick-off call to begin onboarding and implementation. The purpose of this call is to introduce you to your Aldrich accounting team, provide an overview of the onboarding and implementation process, and coordinate next steps for getting started.

Upon completion of onboarding and implementation, we’ll schedule an onboarding wrap-up call with you. The purpose of this call is to review roles and responsibilities for recurring services, confirm alignment on service cadence and due dates, and mark the transition into our ongoing operating rhythm.

As you work with us, it’s natural for your accounting and business needs to grow and evolve—and we’re here to grow with you. That may mean moving to a new Outsourced Accounting service tier or exploring other services offered by the Aldrich Group of Companies. Wherever your business goes, you can trust that we’ll be by your side through every stage of its life cycle.

The Value of Working with Aldrich

Hear from Nate Bailey – Aldrich client and Co-Founder + CEO of Ideation, on the value of working with the Aldrich – Outsourced Accounting Team.

Meet our Outsourced Accounting Founder

Partner + Director, Outsourced Accounting (CAS)

Eric Seifert, CPA, MAcc

Aldrich CPAs + Advisors LLP

Eric Seifert joined Aldrich in 2013, shortly after completing graduate school. In 2021, Eric founded Aldrich’s Outsourced Accounting group, which provides clients with a top tier accounting team focused on delivering timely accounting information, insights, analysis, and advice. His expertise is in business strategy development, financial modeling, process assessment, and leadership. Eric joined the Aldrich… Read more Eric Seifert, CPA, MAcc

Eric's Specialization

- Business strategy development

- Financial modeling

- Process assessment

- Leadership