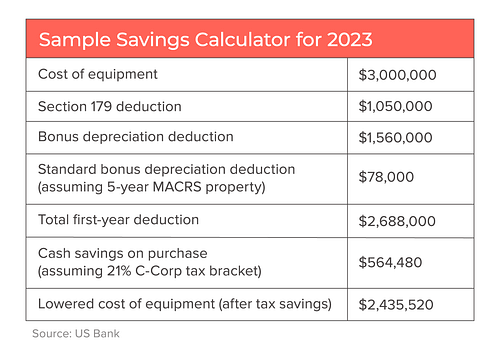

For the last five years, manufacturers have enjoyed a bonus depreciation tax incentive. The Tax Cuts and Jobs Act of 2017 (TCJA) increased bonus depreciation by allowing business taxpayers to deduct 100% of eligible asset expenses upfront from their taxable income rather than having to depreciate the cost over several years.

The intent was to leave business owners with more cash to invest in their businesses and spur capital purchases. This accelerated depreciation has been a significant tax saving for manufacturers that purchase equipment.

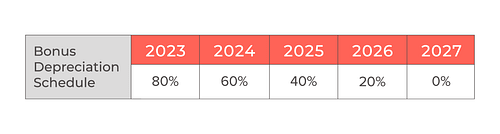

The full 100% bonus depreciation tax benefit ended on Dec. 31, 2022, and will continue to ramp down by 20 points annually through 2026. The phase-out may impact manufacturers who regularly make large-ticket capital equipment purchases and have relied on bonus depreciation to lower their taxes.

Manufacturers should know the changes and proactively plan for the phase-out. Now may be an ideal time to consider upgrading or adding equipment to minimize tax liabilities before time runs out. Here are things to remember for tax planning in the years ahead to ensure you take advantage of the phase-out.