Aldrich Wealth LP is pleased to be recognized by multiple publications in their annual rankings of wealth management firms across the US. Financial Advisor (FA) magazine named Aldrich Wealth 29th on its Top 50 Fastest-Growing Firms list. The firm was also honored in the Top 200 of the FA Annual Registered Investment Advisor (RIA) Rankings. Results were derived from year over year AUM comparison of figures provided by the RIA.

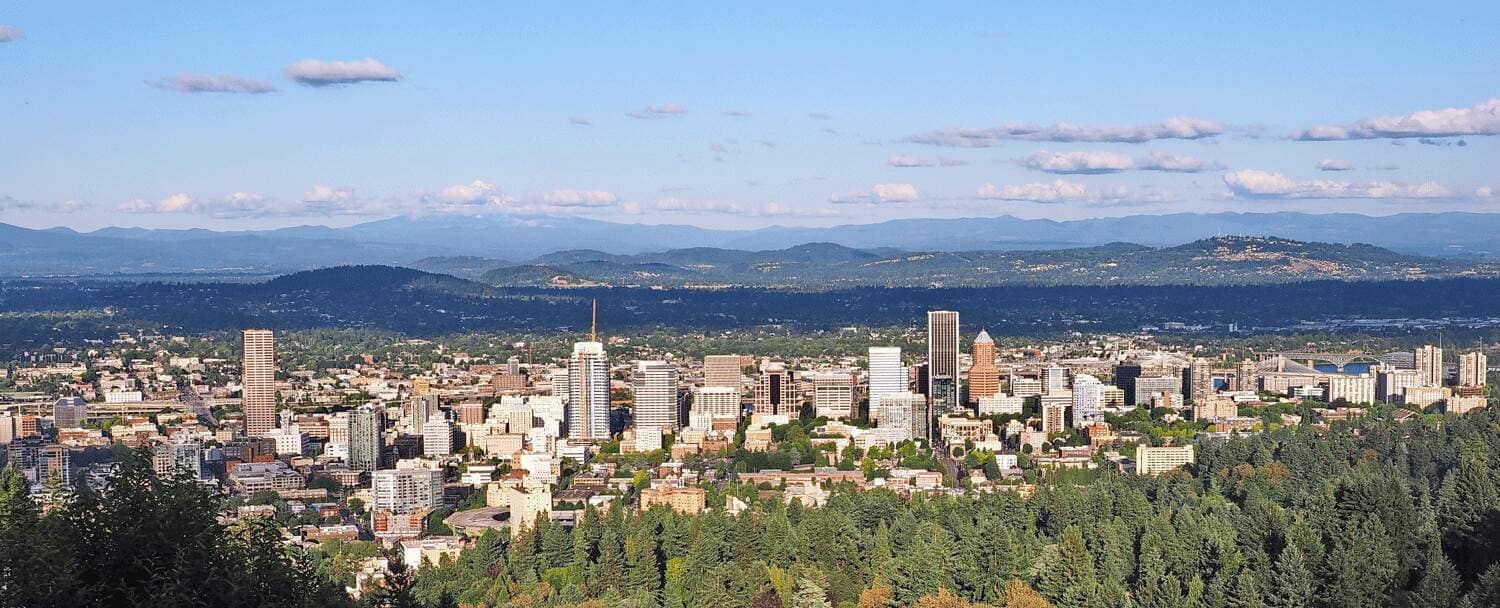

In the same month, Accounting Today recognized Aldrich Wealth as the 24th largest wealth management firm affiliated with an accounting firm based on assets under management. This was the 13th annual Assets Under Management ranking, including more than 150 firms that provided information to the publication. Additionally, the firm was named a 2019 Top 300 RIA by 2019 Financial Times for the third year. Aldrich Wealth is one of only two advisors from the Pacific Northwest to receive this recognition.

Aldrich Wealth is a dynamic, fast growing and established independent registered investment advisor (RIA) at the forefront of the industry. As an RIA that provides a broad array of financial services to high net worth individuals and corporate retirement plans, Aldrich Wealth manages nearly $2 billion in assets. Founded in 1998, Aldrich Wealth is part of the Aldrich Group of Companies, which includes Top 100 Accounting Firm Aldrich CPAs + Advisors, Aldrich Benefits, Aldrich Retirement Services and Aldrich Business Transitions.

The Aldrich Group is recognized as one of the Top 10 Best of the Best Accounting Firms by Inside Public Accounting, Best Places to Work, and Healthiest Employer. The Aldrich Group serves clients with deep industry experience in construction, manufacturing, real estate, healthcare, nonprofit, telecommunications, utilities, professional services, food processing and agribusiness, as well as a variety of privately held companies and individual clients.

For more information regarding the selection criteria and other important details for the rankings, please see the disclosures below.