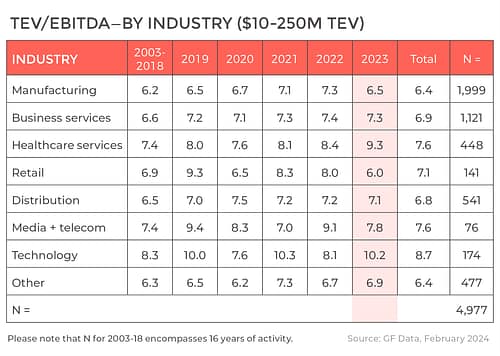

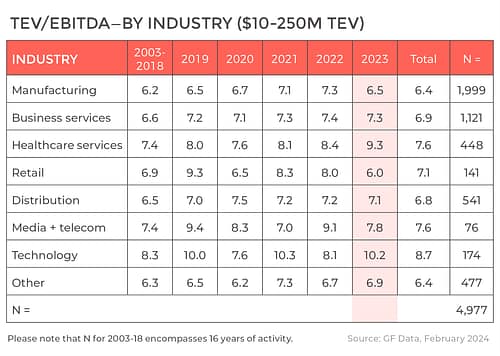

According to GF Data’s 2023 highlights, valuations on completed deals through the end of 2023 averaged 7.5 times Trailing Twelve Months (TTM)-adjusted EBITDA. This is a 0.2x increase from the third quarter and surpasses the 6.7x average in the second quarter of 2023. However, average multiples for the year slightly dipped to 7.3x, in contrast to the 7.6x averages in 2022 and 2021.

As 2024 progresses, valuations remain under pressure but seem to be staying on par with the year-end 2023 figures. Buyers are using seller financing and earnouts more to bridge value gaps in the current market.

Although there were fewer deals, deal valuation increased toward the end of last year, especially for smaller transactions. Deals valued between $10 million and $25 million saw a notable improvement of more than half a turn toward the end of the year. The average valuation reached 6.6x, compared to 5.9x in the third quarter.

Deals valued between $25 million and $50 million improved, but more modestly. By the end of the year, the average valuation increased to 7.0x.

Overall, the first three months of 2024 saw continuous improvement. But regardless of how the market performs, one thing does not change: buyers want quality businesses. Those sellers who are growing, have strong margins, and can scale will almost certainly find interested partners.