Since the implementation of the Inflation Reduction Act of 2022 (IRA), there have been significant changes to the federal tax credits that offset the cost of purchasing a new electric vehicle (EV) or plug-in hybrid electric vehicle (PHEV) for personal use. This article will help you determine if you qualify for the tax credits.

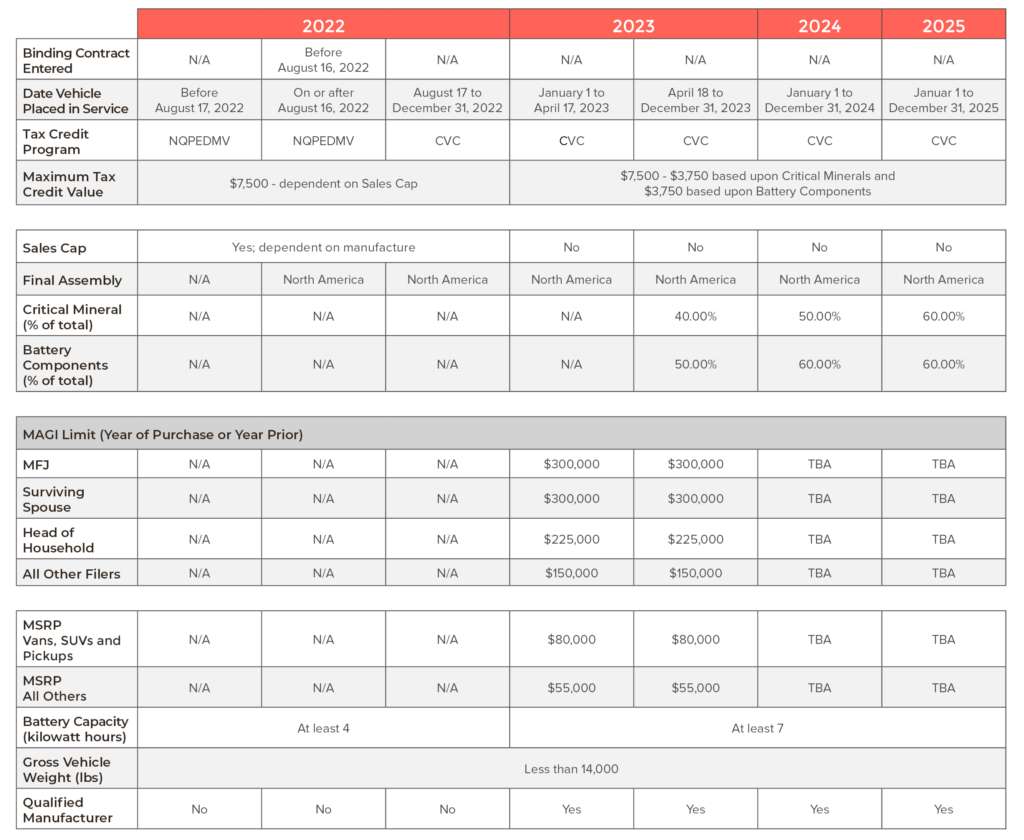

To better understand the tax credit programs, it’s essential to compare the old New Qualified Plug-in Electric Drive Motor Vehicle (NQPEDMV) Credit with the new Clean Vehicle Credit (CVC) programs. We covered this topic in detail in an earlier article. However, with the recent revisions, we want to present an abridged version to help you assess your eligibility for the tax credit.