Dentistry is very profitable for those who secure the right practice and manage it efficiently. According to the Bureau of Labor Statistics, the median income for a dentist is $149,500, but our average general dentist makes over $300,000. Specialty practitioners typically realize even greater income. As your practice matures, begin to diversify your assets by investing more and more into a tax-qualified retirement plan.

In 2015, a 50-year-old dentist with the right 401(k) Profit Sharing Plan can set aside $59,000 for retirement. If the dentist is married to a 50-year-old, another $24,000 can be set aside. If the dentist pays a combined federal and state marginal tax rate of 40 percent, the after tax cost of these savings amounts to $49,800. By adding a cash balance plan to the practice and operating it in combination with a 401(k) Profit Sharing Plan, the dentist will be able to increase contributions up to $314,000 at a reasonable cost for the staff.

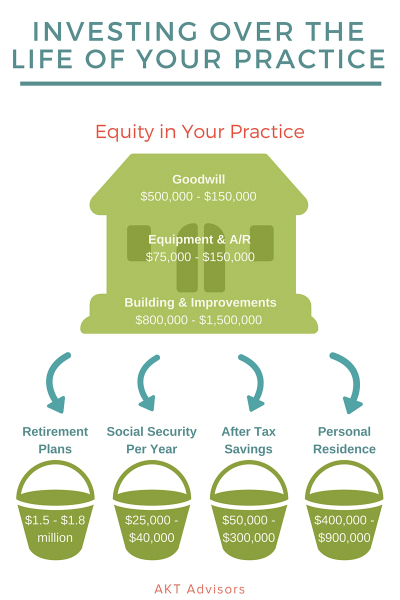

In addition, maximizing your retirement funding – by funding a Roth IRA and developing an after-tax investment strategy – will allow you the flexibility to control your tax bill in retirement by structuring distributions from your different “buckets” of funds. As your practice matures and your debt load eases, Aldrich Wealth can help you craft investment strategies consistent with your age, risk tolerance and preferences.