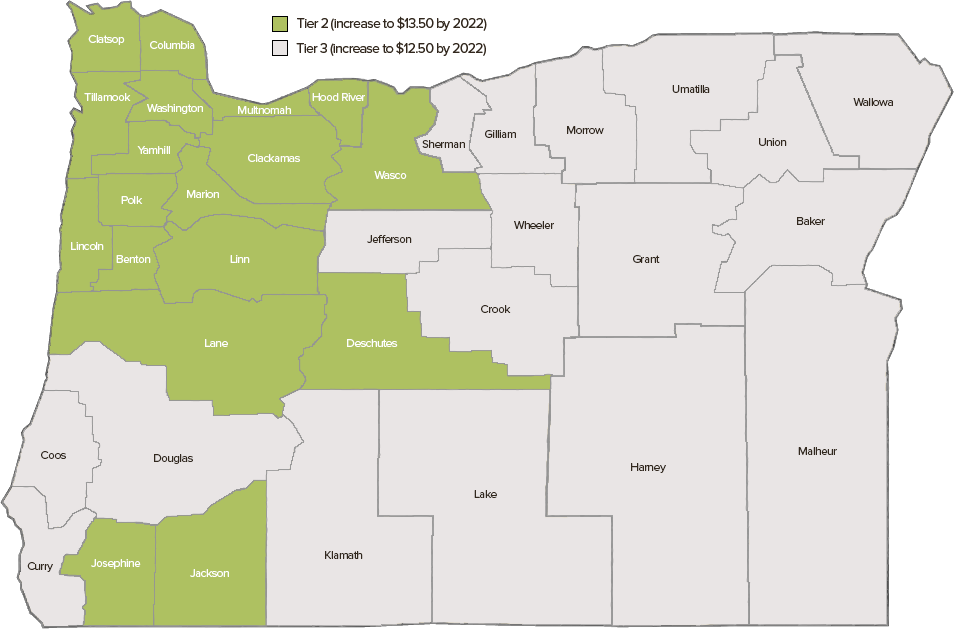

In March 2016, Governor Kate Brown signed Senate Bill 1532 into law, raising the state’s minimum wage over time to $14.75 an hour in metro Portland, $13.50 in counties like Clackamas, Benton, and Marion, and $12.50 in rural counties. As of July 1, 2016, Oregon no longer has a standard minimum wage across counties.

Here is the timeline of the planned minimum wage increases for each designated geographic “tier” in Oregon:

| Date | Tier 1 Portland Urban Growth Boundary |

Tier 2 Willamette Valley |

Tier 3 Rural Counties |

| July 1, 2016 | $9.75 | $9.75 | $9.50 |

| July 1, 2017 | $11.25 | $10.25 | $10 |

| July 1, 2018 | $12 | $10.75 | $10.50 |

| July 1, 2019 | $12.50 | $11.25 | $11 |

| July 1, 2020 | $13.25 | $12 | $11.50 |

| July 1, 2021 | $14 | $12.76 | $12 |

| July 1, 2022 | $14.75 | $13.50 | $12.50 |

The wage hike significantly impacts many business owners, but the farming industry may take the biggest hit. According to Oregon State University, agriculture’s economic footprint in Oregon tops $34 billion annually. With 90 percent of Oregon agriculture located in the second geographic tier, many family farms and ranches may struggle to absorb these state-imposed cost increases.

The federal minimum wage has remained at $7.25 per hour since 2009. While the Fed may adjust that minimum in the coming years, as currently constructed, Oregon’s minimum wage could reach 86 percent above the federal minimum and is set to be the highest in the country.

Oregon’s projected minimum wage will climb to 43 percent above Washington’s ($9.47 per hour), 35 percent above California’s ($10 per hour) and 86 percent above Idaho’s ($7.25 per hour). For eastern Oregon, Idaho’s significantly lower minimum wage presents stiff competition in labor costs.

With the minimum wage projected to consistently climb over the next six years, it is important to have a game plan moving forward. Here are some topics to discuss with your business consultant when planning for this wage hike:

- How efficient is your cost structure?

- What are your margins by crops/commodity?

- Is there technology that can help reduce labor costs?

This post was originally published on February 25, 2016. It was updated on April 17, 2017 to provide you the most current information.